What If You Could Build Real Wealth… Even If You Have No Time, No Savings, and No Margin Right Now?

Learn how everyday people are using the 3 Paydays® System to build predictable cashflow, long-term wealth, and financial freedom without banks, credit, or extra hours you don’t have.

SMART REAL ESTATE COACH

Led by our family team, is a Wicked Smart® Community of Associates all across North America that empowers individuals and families to live the life of their dreams. If you’re serious and committed to actually completing transactions, then Smart Real Estate Coach is designed specifically for you!

Hands-On Coaching

Our Associates know the value of our expertise because they're constantly seeing it in action. Not only do we coach these new investors, we partner on deals to bring the most value we can to the table.

Constantly Improving

You'll never find us falling into a state of complacency, content in making a product and then letting it sit to collect dust. While our values and methods remain the same, we're always improving the quality of our content.

Supportive Community

Being a part of the Wicked Smart® Community doesn't just mean you have access to us, but a nationwide network of like-minded Associates who've been where you've been and are willing, contributing assets.

Get your free copy of these best-selling books!

We'll mail you a package with copies of both Real Estate On Your Terms and Deal Structure Overtime, at absolutely no cost to you. We'll even pay for shipping!

If you're serious about making money in the Real Estate Investment Business, then you can't afford to miss our complimentary Mastersclass!

We’ll be covering the following topics and pitfalls:

What does it mean to buy real estate “on TERMS”?

How to create 3 Paydays® for every deal you do vs. getting paid once to wholesale or rehab

How to buy properties with none of your own cash or credit at risk

Turn your present properties into cash

Where to find homeowners who want to sell on TERMS?

How to become a “Transaction Engineer” able to structure any type of deal that comes your way

Where to get all the tools necessary to build a TERMS business

How you can work with our family team IN THE TRENCHES doing deals

How to make your business and deals “Recession Resistant”

Navigating the laws and regulations of this specific niche

STOP spending money on so-called “automated systems” that mentors tell you are the magic pill

How you can keep your cashflow and lose the hassle of tenants

Where and how to find the right buyers for your properties on TERMS

How to buy your own home on TERMS

AS FEATURED ON

Study at Wicked Smart® Academy

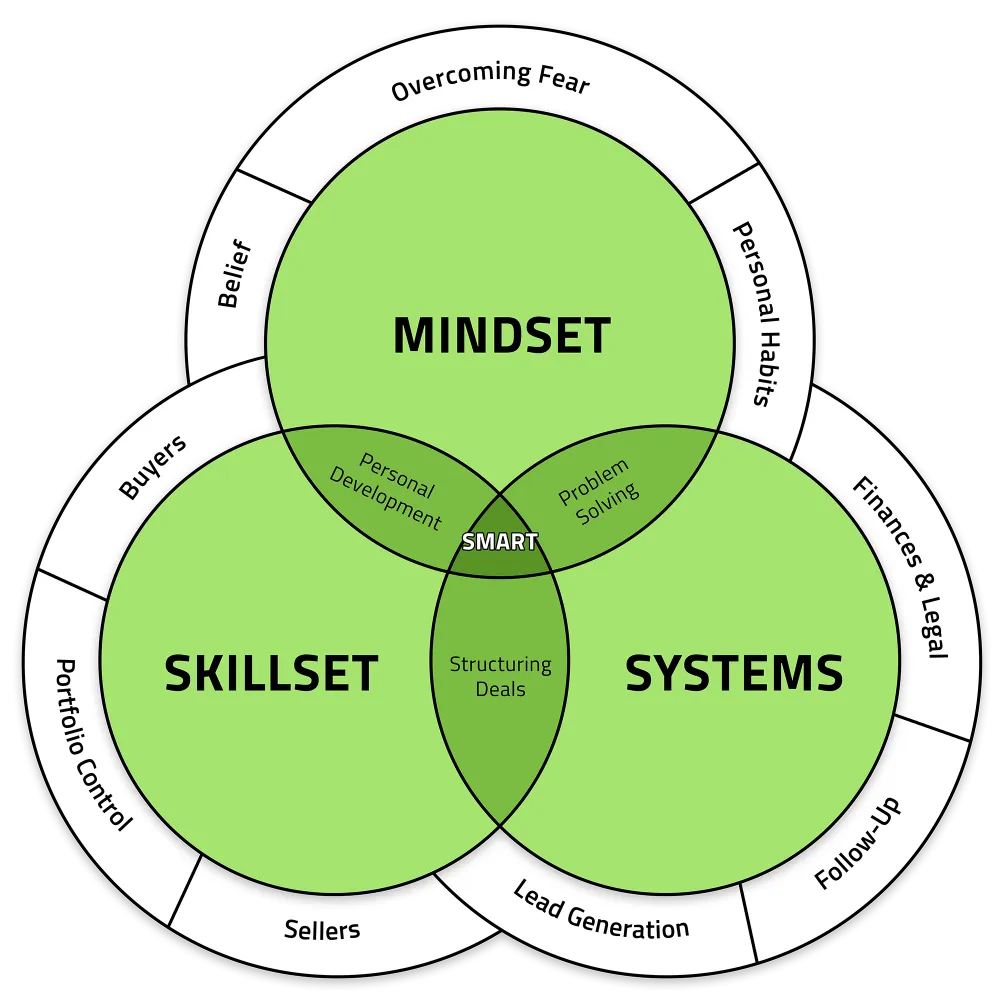

Our self-guided online video courses have everything you'll need to start buying and selling on terms, scale your business, and get your head screwed on right. With practical knowledge and insight on mindset, skillset, and systems, going through these courses will place you directly on the path to becoming a successful real estate investor.

DON'T WAIT! SIGN UP NOW AND GET INSTANT ACCESS TO THIS LIFE-CHANGING WEBINAR.

Copyright © 2014-2025 Smart Real Estate Coach®. All rights reserved.

221 Third St, Admirals Gate Tower, Suite 201, Newport, RI, 02840

Contact Us by Phone at (855) 667-7336 or Email at

[email protected]